GP-led Secondaries: Bridging The Private Equity Liquidity Gap with Continuation Vehicles

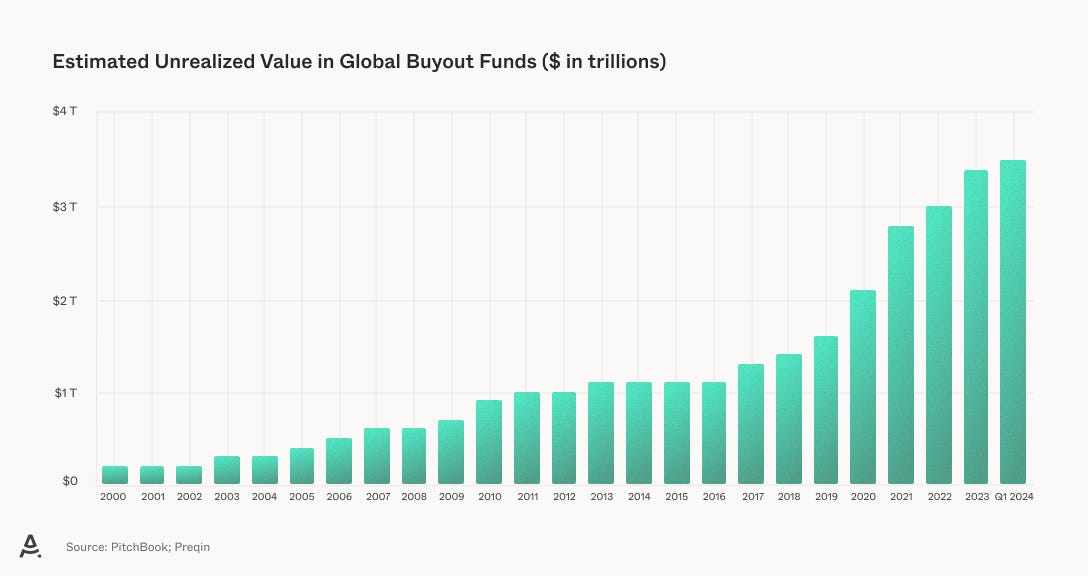

Since 2022, traditional exit markets have slowed dramatically. IPO activity remains tepid, strategic acquirers are cautious, and sponsor-to-sponsor exits have declined from peak levels. As a result, more than 40% of buyout net asset value (NAV), valued at over $3 trillion, is now held in assets older than four years[1]. This concentration of unrealized aging value has forced both sponsors and LPs to reconsider how they generate liquidity in a constrained exit environment.

In response, GP-led secondaries, especially continuation vehicles (CVs), have evolved from niche structures into mainstream liquidity tools. These vehicles can enable GPs to roll high-conviction portfolio companies into newly formed funds, often while securing new capital commitments and offering optionality to existing LPs. In 2024, GP-led secondaries were on track to generate $50 to $60 billion in exit value[2]. Importantly, they are no longer seen as a last resort, but rather as a deliberate, strategic solution to manage portfolio maturity, reinvestment timelines, and investor liquidity preferences.

Understanding continuation vehicles: mechanics and structure

How GP-led continuation vehicles work

A GP-led secondary is initiated by a sponsor seeking to crystallize value or extend ownership of a particular asset. In a typical single-asset continuation vehicle (SACV), the GP conducts an auction to sell the asset from its legacy fund into a newly formed CV. Existing LPs are offered the choice to cash out, roll their exposure and get diluted, or roll and commit new capital into the new vehicle. Secondary investors will also provide new capital, which is used to fund the CVs purchase of the asset. This process sets a market price, allows the GPs to realize carried interest from the original fund, and may introduce liquidity to LPs without forcing a suboptimal exit.

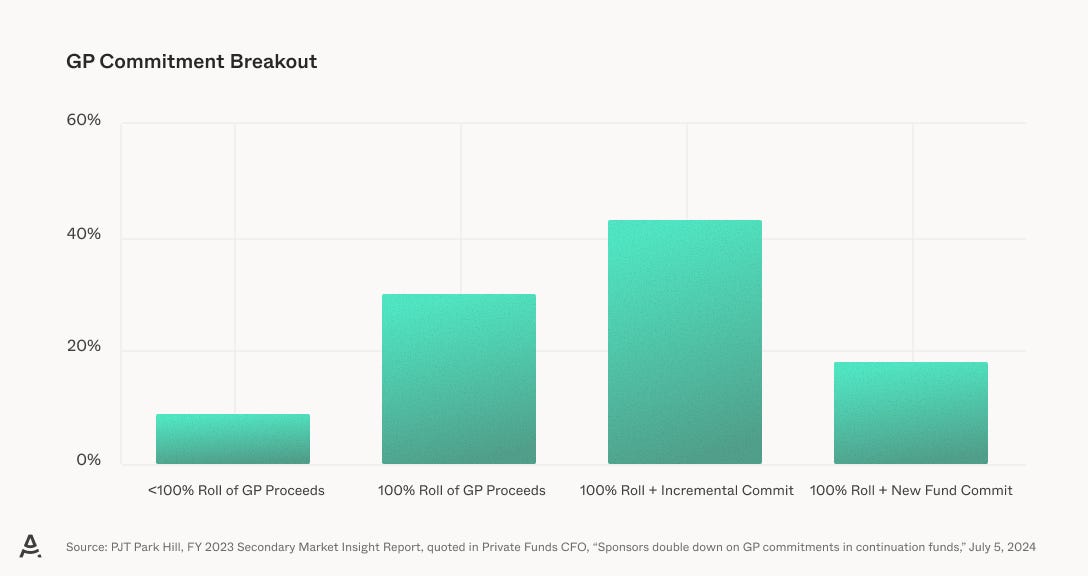

To ensure alignment and reduce information asymmetry, the use of fairness opinions, or independent third-party valuations, have become common practice. In many cases, the GP crystallizes its carried interest and rolls all proceeds, and in some instances, it also contributes additional capital. This gives secondary investors confidence that they are not disadvantaged by an information imbalance and that the GP also believes there is a credible path to future growth for the asset.

Single-asset vs. multi-asset structures

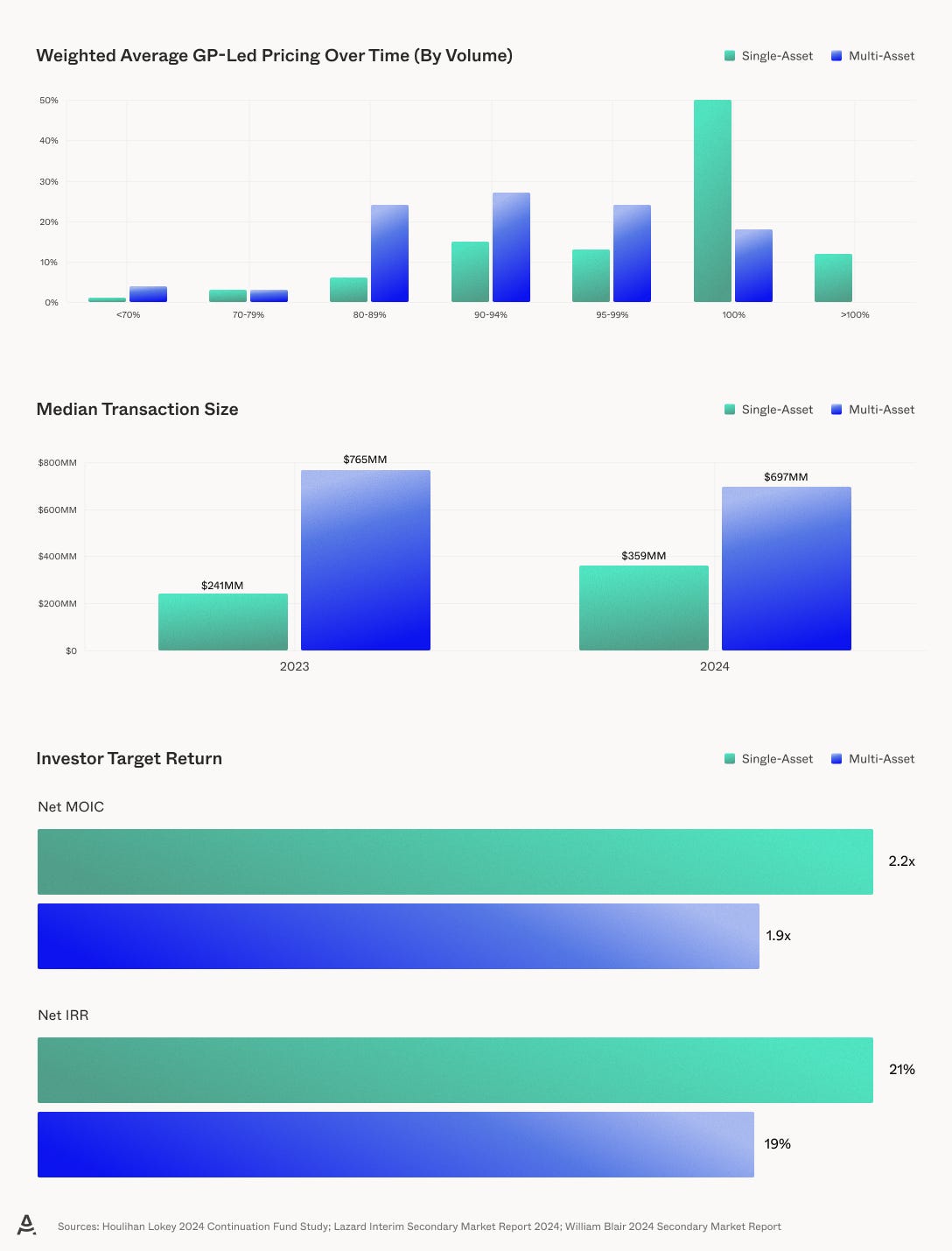

SACVs, representing roughly 40% of GP-led volume[3], tend to focus on “trophy” assets, i.e., businesses that have performed well and for which the GP believes there is further upside and value to be created for investors. The structure is comparatively straightforward - a single asset and a clearly defined value-creation plan, which facilitates granular due diligence and often accelerates execution timetables.

By contrast, multi-asset continuation vehicles (MACVs) package several assets, often from end-of-life funds, to diversify risk and provide liquidity at scale. While MACVs offer broader exposure, they typically feature lower return dispersion and higher structural complexity. Certain MACVs can include eight or more companies, sometimes from multiple fund vintages managed by the GP. For LPs, MACVs can be more difficult to evaluate given the varied performance trajectories, sectors, and end-market exposures embedded within the vehicle. It is not unusual for MACVs to pair a marquee asset with others that are less compelling, though still viable assets.

The structural tailwinds behind GP-led growth

Several durable tailwinds are driving the rise of continuation vehicles:

Exit market dislocation

With IPO markets subdued and corporate buyers constrained by higher rates and financing costs, GPs have fewer traditional exit options. GP-led secondaries fill this gap by enabling partial or full exits without surrendering control of high-performing companies. The challenge is particularly acute for mid-cap and upper-mid-cap businesses that are too large for strategic acquirers but not yet suitable for a public offering. CVs aim to create a liquidity solution that preserves momentum and continuity.

Increasing sponsor adoption

Around 80% of the top 100 GPs have completed continuation fund transactions.[4] This trend highlights the utility of continuation funds as what we believe to be a now permanent fixture in the portfolio management toolkit. Additionally, as more firms enter the market and competition for high-performing companies intensifies, GPs are increasingly reluctant to sell assets with strong future growth potential, particularly to other GPs. Instead, they may prefer to retain ownership to capture additional upside.

Maturing assets and longer hold periods

The average holding period for individual buyout assets has reached six years, the longest on record. This trend highlights the growing demand for liquidity solutions later in a fund’s life. In some cases, CVs also serve as an extension tool that aligns exit timing with market recoveries, helping sponsors avoid forced monetizations during cyclical troughs.

Standardization and governance

Guidance from the industry body, ILPA, has established best practices around pricing, transparency, and process fairness, improving LP confidence. Meanwhile, deal structures now routinely include fairness opinions, GP rollover requirements, and escrowed capital to align incentives. The increasing predictability of process and investor protections is helping to scale CV adoption among seasoned and emerging sponsors.

Capital formation and dedicated funds

Secondary buyers have raised record levels of capital to target GP-leds, with increasing specialization by strategy and sector, with ’40 Act vehicles and retail platforms expand the investor base. Large platforms have committed significant capital to dedicated GP-led strategies, underlining growing institutional interest. Additionally, traditional buyout funds are beginning to pursue hybrid secondary strategies, further blurring the line between primary and secondary capital.

PitchBook projects GP-led deal flow to exceed $100 billion per year by 2028, a 13.2 % CAGR from 2022.2 Supply is being fueled by aging primary funds, while demand grows from LPs’ need for liquidity. As private-capital AUM continues to grow, the secondary market, particularly GP-led transactions, will become an even more critical strategic tailwind for sponsors and investors.

If private capital AUM continues to scale, the structural importance of secondaries, particularly GP-leds, will only grow.

Evaluating continuation fund performance

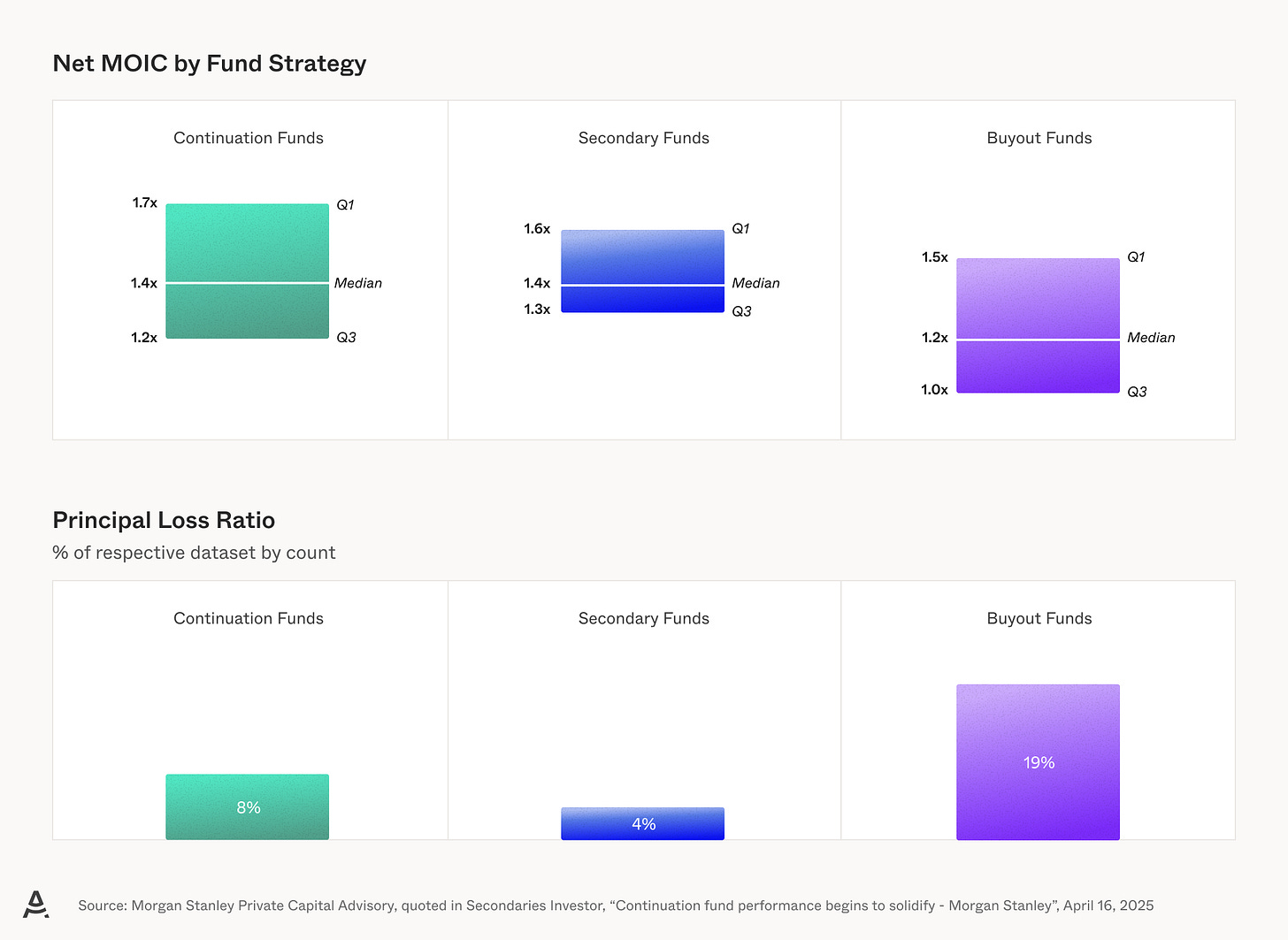

The rise of GP-led secondaries is not just a function of necessity, but of proven performance. CVs have demonstrated the ability to deliver attractive risk-adjusted returns on both an absolute and relative basis.

Return dispersion and risk considerations

While SACVs offer higher upside potential, they also come with concentration risk. These vehicles are typically structured around a single asset, meaning fund-level performance solely depends on that one company. To mitigate potential downside, underwriting expertise, alignment of interest, and third-party validation are essential.

By contrast, MACVs offer diversification benefits but may deliver returns closer to the median. They often include assets not prioritized for near-term monetization and may require more operational effort to stabilize or grow. This underscores the importance of manager selection and understanding the rationale behind the asset grouping for allocators.

Portfolio construction considerations

From a portfolio construction standpoint, continuation funds offer several benefits. First, they accelerate liquidity. Because the underlying assets are seasoned and already cash-generative, distributions are often expected in a shorter time frame relative to traditional buyout funds. This helps LPs better manage their pacing models and denominator constraints.

Second, continuation funds provide exposure to de-risked growth. Most assets rolled into CVs have already undergone their transformational, high-growth phase and are now focused on scale and optimization.

Additionally, CVs support vintage diversification. Traditional private equity funds are often clustered around market cycles, while GP-leds occur based on asset readiness. This asynchronicity can improve risk-adjusted returns across the broader PE portfolio.

Lastly, GP-leds offer optionality and customizability. LPs can choose to roll or cash out. New investors can negotiate structures that fit their portfolio needs, and sponsors can extend their best-performing assets without resetting blind pool risk.

What Allocate looks for in GP-led secondaries

Allocate approaches the GP-led market with a highly selective lens. We prioritize SACVs over MACVs, particularly where there is:

Full GP rollover of accrued carry and new capital commitments

Independent third-party fairness opinions and price discovery

Clear operational playbooks and direct sector underwriting expertise

Conservative entry valuations and underwriting assumptions

Embedded structural protections that mitigate downside risk

We seek to avoid broadly syndicated MACVs that lack asset-level curation or where GP incentive alignment is diluted. We will typically invest only when we have high conviction in the bulk of assets within the vehicle. Our priority is to partner with GPs with direct buyout underwriting experience and who can deliver repeatable operational advantages and not merely provide capital.

Conclusion: A strategic tool for liquidity and alpha

GP-led secondaries are no longer a nascent private markets strategy. They are a proven, scalable solution for sponsors navigating a more complex and liquidity-constrained private equity environment. For LPs, they represent a compelling bridge between exposure to mature assets and near-term liquidity.

The alignment inherent in a well-structured CV, where the GP rolls carry, capital, and conviction, helps ensure focus and discipline. As the continuation fund market matures, allocators with rigorous underwriting and manager selection processes will be best positioned to capture its dual benefits - shortening the liquidity timeline while preserving upside potential.

The convergence of structural market dynamics, sponsor familiarity, and institutional capital formation suggests that GP-led secondaries will become a staple of balanced and diversified private equity allocation strategy. For investors willing to evaluate each opportunity on its individual merits, continuation vehicles offer a valuable lever for both liquidity management and alpha generation.

[1] Bain & Company, “Have Secondaries Reached a Tipping Point?”, Hugh MacArthur, Brenda Rainey, Or Skolnik, and Alexander De Mol, March 2024

[2] PitchBook, “GP-Led Secondaries”, Nicolas Moura, CFA, December 2024

[3] PJT Partners, “H1 2024 Secondary Market Insight”, July 2024

[4] https://www.harbourvest.com/insights-news/insights/research-validates-growing-adoption-of-continuation-transactions/

MARKET COMMENTARY

Any opinions, assumptions, assessments, statements or the like (collectively, “Statementsˮ) regarding market condition, future events or which are forward-looking, including Statements about investment processes, investment objectives, goals or risk management techniques, constitute only the subjective views, beliefs, outlooks, forecasts, projections, estimations or intentions of Allocate Management, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions and economic factors, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond Allocateʼs control. Allocate undertakes no responsibility or obligation to revise or update such Statements. Statements expressed herein may not be shared by all personnel of Allocate.