Owning the Owners: A Primer on GP Stakes Investing

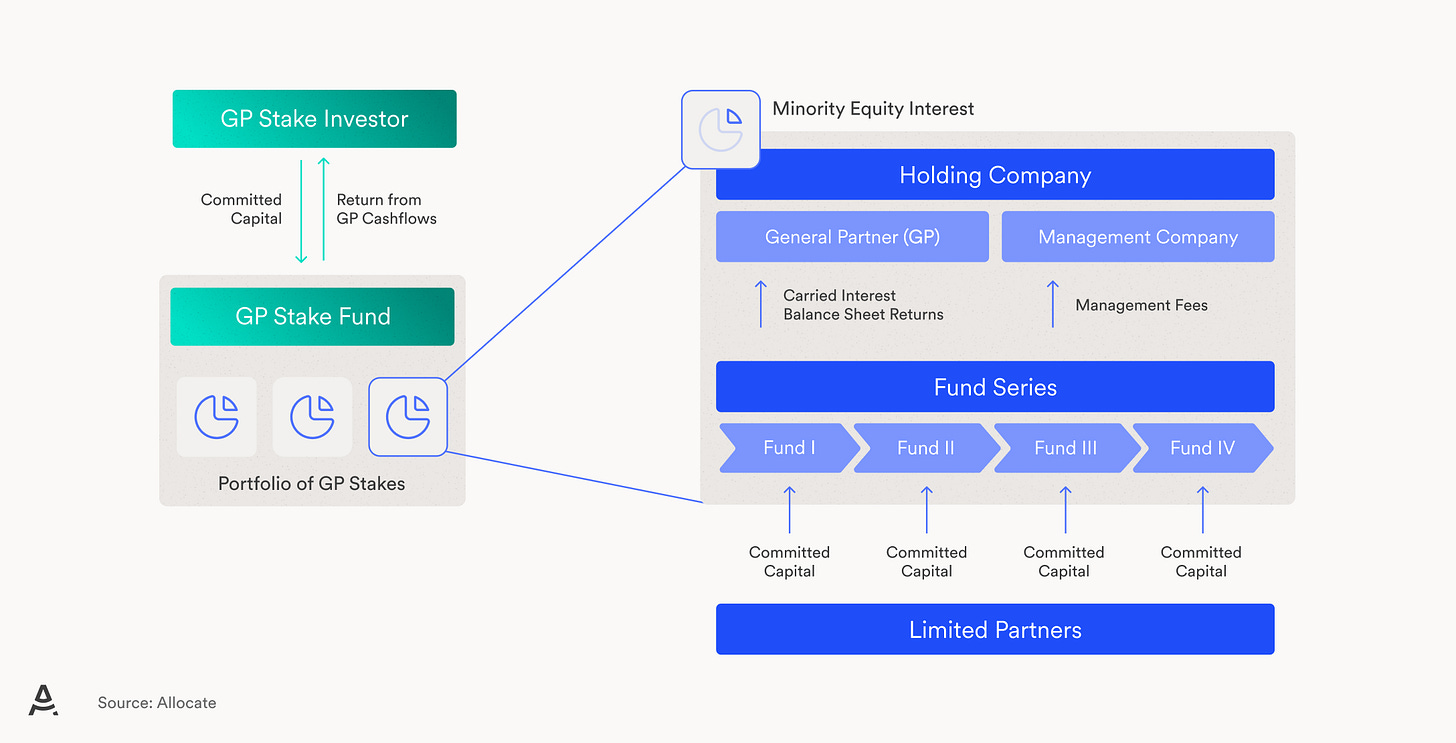

Private equity firms don’t just raise capital to invest in companies. They are high-margin, cash-generative businesses themselves. As the private capital industry has matured, investors have increasingly sought exposure to the business of investing itself. General Partnership (GP) stakes strategies aim to do precisely that by taking passive minority ownership positions in the management companies of private equity firms, to share in their long-term cash flow, carried interest, and increasing value.

A GP stake offers exposure to the enterprise value of a private markets firm, including current and future funds, as well as strategy and geographic expansion, without relying on a single asset or fund. The return drivers are contractual, from management fee income, and equity-linked, from the performance of underlying funds and their carried interest, as well as valuation upside. Unlike fund investments, GP stakes are not constrained by deployment pacing, recycling limitations, or harvest windows. As a result, they provide investors with a differentiated, uncorrelated return stream that complements traditional private equity fund investment.

For many investors, this approach has characteristics of both income and growth. Management fee streams create near-term cash flows, often in the 5% to 8% range, while carried interest and GP ownership offer participation in the growth in the firm’s value. In a maturing private markets landscape, the appeal of owning a slice of the “house” to complement betting on individual funds is increasingly clear.

The Economics of a GP Stake

GP stakes are generally structured to give LPs access to three distinct sources of return:

Management Fees: Often based on a percentage of committed or invested capital. These fees are contractual and generally paid quarterly, creating a relatively stable income stream.

Carried Interest: The share of profits generated by the GP on successful fund investments. This is less predictable but can be meaningful over time.

Balance Sheet Appreciation: Participation in the increase in value of the GP’s own commitments to its funds, co-invest vehicles, or other proprietary investments.

Depending on the firm’s structure, investors may receive distributions tied to one, two, or all three sources of return. In the middle market and seeding segments, where primary capital is primarily used by the GP to grow its business, proceeds may be used to scale fundraising, invest in new strategies, or build out operational infrastructure, enhancing long-term equity value.

Why GP Stakes Today?

Several trends have converged to make GP stakes attractive in the current environment. Slower exits and delayed carry have constrained balance sheet liquidity, especially for firms seeking to fund GP commitments, expand into new strategies, or facilitate succession.

At the same time, the number of investable firms has grown. Since 2010, nearly 4,000 private capital firms have raised over $500 million in total commitments. Yet less than 10% have sold a stake[1], and only a fraction of those have transacted more than once. The result is a deep opportunity set with low penetration.

Finally, the capital scarcity dynamic has added urgency. GPs facing rising GP commitment requirements and more extended hold periods often prefer a non-dilutive, non-control capital partner. Unlike traditional equity sponsors or holding companies, GP stakes investors do not require control, allowing founders to maintain governance while accessing liquidity and growth capital.

Large-Cap, Middle-Market & Seeding:Three Distinct Segments

The GP stakes universe is not monolithic. It spans three distinct approaches that can play different, but complementary, roles in a portfolio. Each of these is outlined below.

Large-cap GP stakes target established firms, often with over $10 billion in assets under management (AUM). These deals are typically secondary in nature, with proceeds going to selling partners. They offer lower risk and relatively stable income, driven by sizable in-the-ground management fee streams across multiple strategies and vintages. Because these firms already command substantial scale, much of the cash flow is realized, with less embedded growth and, therefore, upside. Many investors value the steady income generated by the existing base of fee-paying AUM.

Middle-market GP stakes typically focus on firms managing $1.5 to $10 billion. These transactions are more likely to be primary, with capital going to the balance sheet, and include governance protections and growth-oriented use cases like strategy expansion or generational transition. While these firms have less in-place AUM compared to their large-cap peers, they often are entering their growth phase, creating upside from fund step-ups and platform scaling. The existing cash flows are smaller, but the forward curve is steeper. The ability to underwrite both current income and enterprise value appreciation makes the segment particularly attractive.

GP seeding strategies back emerging managers in Funds I through III, often taking both a management company stake and an anchor LP commitment in their early funds. The LP commitment typically drives the majority of returns, often enhanced by preferential economics - lower fees and rates of carried interest. Seeding offers the most asymmetric upside, but also requires the deepest underwriting and highest conviction. Many managers include co-invest rights, fee holidays, or participation in successor funds for underlying LPs as part of the seeding package. In a concentrated portfolio, manager selection becomes paramount.

Each approach can complement LP portfolios in different ways - large-cap for income, middle-market for balanced growth and strategic access, and seeding for concentrated upside and innovation exposure.

Exit Considerations

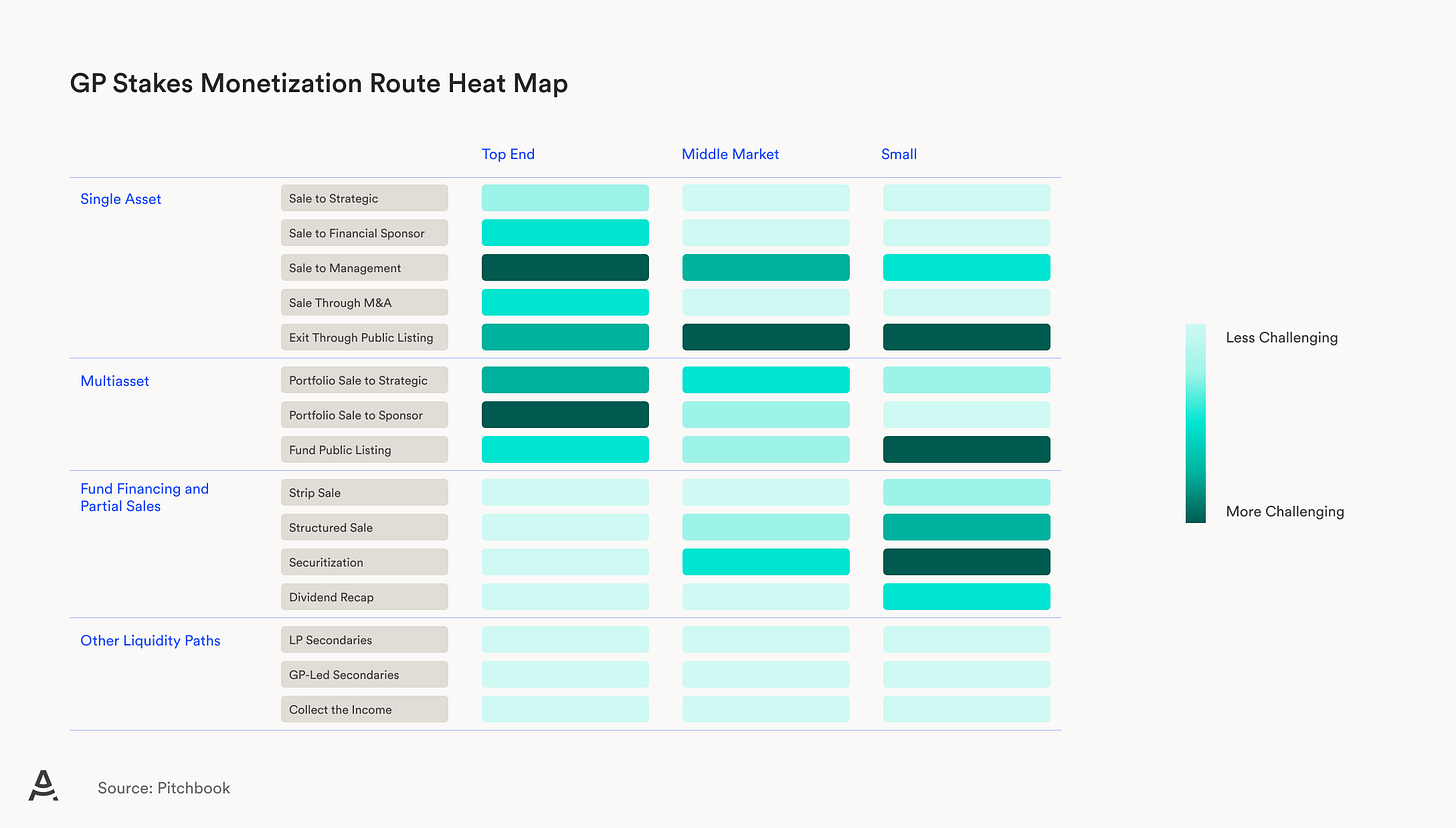

GP-stake funds, with the exception of seeding vehicles that follow a traditional fund life, are typically structured as perpetual capital. Even so, managers often pursue exit options to address the liquidity needs of investors -sensitive to early return on capital. These exits can take multiple forms, each with distinct implications for timing, control, and value realization. Active strategies include a portfolio sale, in which the entire portfolio is sold to a strategic or financial buyer, or a portfolio listing, where the portfolio is taken public through a market listing. A single asset sale may also occur, representing the disposition of a GP stake in a one-off transaction, often to another GP-stake investor or back to the GP itself.

More structured approaches, such as fund financing, use debt or preferred equity to accelerate distributions to investors without a complete exit. Secondary transactions, whether GP-led or LP-led, allow for the transfer of positions to new investors, providing liquidity while maintaining the underlying portfolio. In more passive scenarios, a “drag” can occur, where a GP-stakes fund is compelled to participate in a transaction initiated by individual managers, sometimes at a timing or valuation not of the investor’s choosing.

Characteristics of an Attractive Manager

As the market evolves, discipline matters. Investors should prioritize managers who act like strategic partners, not passive investors. A compelling GP stakes strategy should provide more than capital, bringing operational leverage, aligned incentives, and clear visibility into enterprise value creation.

Specifically, investors should look for:

Alignment: Structures with protections around dilution, key-person risk, and downside scenarios

Growth levers: Ability to accelerate AUM growth, expand into adjacencies, or enhance platform quality through talent and infrastructure

Underwriting clarity: A well-defined view on return drivers, including income from management fees, carry participation, and potential for appreciation of the underlying GP firm

Investors should also evaluate platform quality, track record durability, investor composition, product complexity, and succession depth. While performance remains essential, enterprise value is increasingly driven by supporting operations and infrastructure, such as investor relations, talent retention, data systems, and compliance.

Conclusion – Why GP Stakes Belong in the Portfolio

GP stakes investing offers a way to participate directly in the economics of private markets firms, capturing both contractual cash flows and the upside from long-term enterprise value growth. By spanning large-cap, middle-market, and seeding opportunities, the strategy can complement existing private equity allocations while addressing objectives such as steady income, balanced growth, and concentrated upside. This exposure provides investors with strategic access to the managers shaping the industry’s future and the potential to participate in their operational and enterprise value expansion. In short, the best GP stakes managers don’t just buy equity. They build equity value in platforms that matter for the future of private markets.

[1] Wall Street Journal – Kreutzer, Laura. Pact Capital Partners Takes Minority Stake in Accel-KKR. January 7, 2025.

MARKET COMMENTARY

Any opinions, assumptions, assessments, statements or the like (collectively, “Statementsˮ) regarding market condition, future events or which are forward-looking, including Statements about investment processes, investment objectives, goals or risk management techniques, constitute only the subjective views, beliefs, outlooks, forecasts, projections, estimations or intentions of Allocate Management, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions and economic factors, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond Allocateʼs control. Allocate undertakes no responsibility or obligation to revise or update such Statements. Statements expressed herein may not be shared by all personnel of Allocate.