The Evolution of Venture Lending: Fueling Innovation Through Specialized Debt Financing

By Nic Millikan, Managing Director and Head of Client Solutions

When investors think about venture capital (VC), they typically think about equity investments made into innovative startup companies within the private markets. However, accompanying almost 40% of venture deals is a small but growing part of the VC ecosystem, venture lending.1 Venture lending refers to the practice of providing debt financing to startup and growth-stage companies that have typically already raised one or more equity rounds of venture capital.

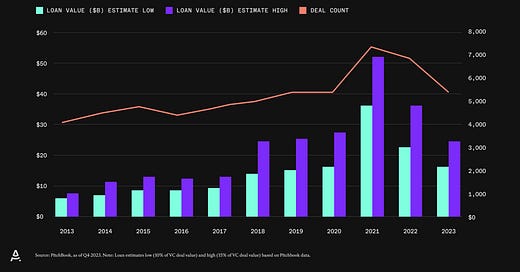

While specialty lenders and banks have long worked with venture-backed startups, dedicated venture lending strategies and asset managers also emerged to initially support software companies in the 1980s to the 1990s dot-com era. As venture capital moved into new sectors of the economy, venture lenders followed, focusing on the unique risk profiles and financing needs of these startups, which required specialized underwriting and financing structures. Since these early beginnings, estimates put the size of the venture lending market at between 10% and 15% of the overall VC market, valuing the US venture lending market at between $17 billion and $25 billion in 2023.23

Why Borrowers Seek Venture Lending

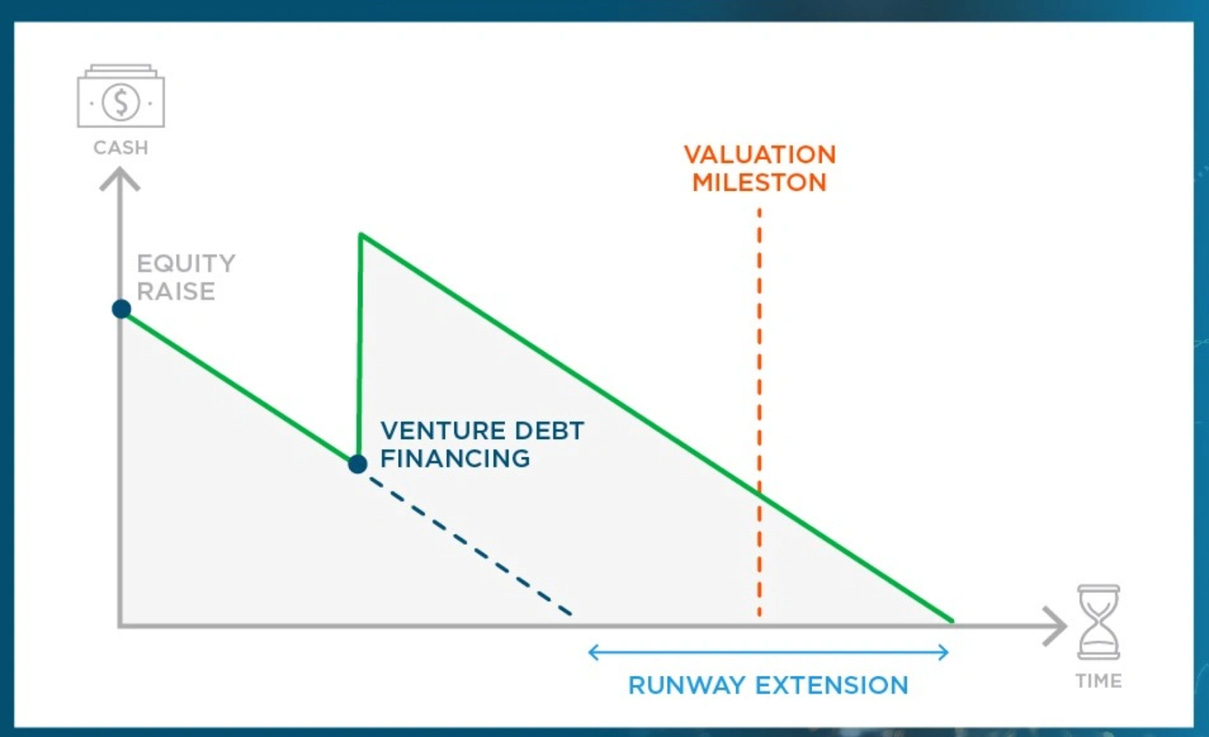

A startup may seek out borrowing to access non-dilutive capital to extend the time, also known as runway, or accelerate growth between equity rounds. Additionally, given the high cash burn rates of startups and the high cost of equity capital, borrowing may prove to increase overall capital efficiency.

For example, to avoid dilution, a company that has recently completed an equity round may have several milestones to reach before raising its next round. If on the way to reaching those milestones they require more working capital or more time, they could access borrowing instead of issuing more equity, which would dilute existing equity holders. Additionally, it is common for startups to require additional capital for specific product development or growth initiatives to allow them to hit the next milestone and increase their overall valuations.

The illustration below highlights this process.

The bespoke nature of venture lending can accommodate a range of scenarios for borrowers who are typically looking to solve a very specific, and temporary funding need to reach their next valuation milestone and raise an additional equity round.

An Alternative Loan Structure

To accommodate the diverse nature of the VC industry, venture lenders have adopted a flexible approach to both the terms and structures of loans.

Loan amounts can range from $2 million to over $100 million, with the size of the loan typically proportional to the funding stage requirements of the underlying company – later stage companies require more capital. While specific terms vary, average maturities are generally within the two-to-five-year range and loans can be fully drawn upon closing or structured to be drawn once the company achieves milestones. Additionally, loans are typically secured by a company pledging assets or income streams to backstop or service the loan, while in other cases they may be secured by the proceeds of future equity rounds. This means they are positioned higher in a company’s capital stack.

The interest rate charged on loans can be fixed or variable based on its underlying structure. There are three general types of loans.

Convertible notes: Issued at a discount to face value and requiring no periodic interest payment, the principal and accrued interest convert to equity at the time of a future equity capital raise. This conversion usually occurs at a 10% to 25% discount to the price of the following equity round. These notes generally have a maturity period of between 18 and 24 months, with a low fixed interest rate of around 1% to 2%. The bulk of the return on principal comes from the conversion discount.

Term loans: Issued with a variable interest rate based on the prime rate plus a premium, or spread, which is priced to reflect the perceived risk of lending to venture-based companies. This spread can be as high as 5% to 9%. Additionally, these loans have an origination fee to compensate the lender for the cost of underwriting and structuring a loan. Equity warrant coverage can be in the range of 10% to 20% of the overall loan amount.4

Revenue-based loans: Issued with a repayment cap, these loans tie repayments to monthly revenue streams. A revenue cap will act as the maximum amount repaid on a loan amount, regardless of the timing of the repayment. For example, if a company borrows $1 million with a valuation cap of 1.5x, it would be required to repay the lender $1.5 million on or before the maturity date. If they pay it off sooner, they are typically required to pay the full amount. Valuation caps are generally 1.3x to 2.5x the principal amount of the loan. There are no equity warrants received on these loans.

The Crucial Role of Warrants

Venture loans generally include equity warrants that give lenders the right to purchase equity in the following equity round, typically at a discount. This provides lenders with additional upside and helps to boost overall returns.

Warrants play two crucial roles as part of a loan. Firstly, they help to mitigate overall portfolio risk as their gains have the potential to offset the impact of losses from defaults thereby improving the risk-return profile. Additionally, warrants themselves allow a lender to benefit from equity upside, creating alignment between the borrower and lender to support the overall performance of the loan.

Additionally, the average warrant coverage on venture debt typically translates into ~1-2% of a borrower’s company, leading to lower overall dilution than raising equity capital.5

Venture Lending in a Portfolio

With income from loan repayments and equity upside from warrants, venture lending sits at the intersection of debt and equity financing, leading it to potentially play an important role within a broader investment portfolio in a few key ways.

Diversification – Venture lending provides exposure to young, high-growth companies like venture capital, but with the protection of a debt structure. This can diversify the risk-return profile of a portfolio.

Current Income – Many venture lending funds provide investors with current income in the form of interest payments, typically within the first year. This provides earlier cash flow to a portfolio unlike the longer lock-up periods typical of venture capital and may serve to dampen the overall impact of the J-curve.

Lower Risk – Though still high-risk relative to traditional lending, venture lending sits higher in the capital structure than equity and is typically structured as senior secured debt, as previously mentioned. Recoveries tend to be higher than equity in the event of default.

Enhanced return – The potential to participate in equity upside from warrants differentiates the potential return profile relative to other private credit strategies such as direct lending. It is estimated that equity returns from warrants could be as high as 3% to 5% on top of its yield, which has been approximately 15%.6

The Risks of Venture Lending

Venture lending comes with a unique set of risks when compared with more traditional lending sources given the uncertainties associated with startups and growth-stage companies. Some key risks include:

Default risk - Default rates in venture lending portfolios can range from as low as 2% according to Pitchbook, to as high as 8% in a more challenging economic environment.7

Valuation and model risk: Lenders rely extensively on borrower projections, growth trajectories, and estimated exit valuations in pricing loans and warrants. If these assumptions prove overly optimistic, expected returns suffer.

Equity dilution: Borrowing companies that raise subsequent rounds at lower valuations or take-down rounds can dilute the value of warrant positions and dampen ultimate lender upside.

Macro conditions: Venture lending relies on a healthy VC/startup ecosystem and exit environment. In broader downturns, loans may default at higher rates, and fewer portfolio companies get acquired or go public, potentially hurting warrant returns.

Early exits: If portfolio companies get acquired early, lenders may lose the chance for full warrant gains in addition to losing a performing loan asset off the books. This highlights the importance of portfolio diversification.

Conclusion

Venture lending has evolved from its beginnings supporting software companies to become an integral part of the startup financing ecosystem. By providing an alternative source of financing, venture lending helps high-growth startups extend their runway and reach key milestones while avoiding dilution from additional equity raises. In turn, this specialized form of lending fuels continued innovation across sectors.

As venture capital flows into new sectors and geographies, specialized lenders are likely to follow. With VC dry powder at all-time highs in 2023, there appears to be ample runway for further evolution of venture lending in both size and scope going forward. This presents an interesting opportunity for investors seeking differentiated exposures to the high-growth venture industry and presents the potential for a differentiated but complementary return stream relative to venture equity.

DISCLOSURE

The information on this page constitutes market commentary and is provided by Allocate Management Company, LLC, any of its affiliates or any of its or their affiliates, directors, officers, employees or advisers (collectively referred to herein as “Allocate”) for informational purposes only.

Any opinions, assumptions, assessments, statements or the like (collectively, “Statements”) regarding market condition, future events or which are forward-looking, including Statements about investment processes, investment objectives, goals, risk management techniques, views of possible future outcomes in any investment asset class or market, or of possible future economic developments, constitute only market commentary based on the subjective views, beliefs, outlooks, forecasts, projections, estimations or intentions of Allocate, should not be relied on, are subject to change. Although Allocate believes that the expectations reflected in the Statements are reasonable, no representation is made or assurance given that such Statements are correct or that the objectives of an investment product or service will be achieved or that investors will receive a return of their capital or will not sustain losses. All investments involve risks and uncertainties, as disclosed in the applicable offering documents. Allocate undertakes no responsibility or obligation to revise or update any Statements. Statements expressed herein may not be shared by all personnel of Allocate. This page and the Statements are not intended as investment advice or recommendations by Allocate. It is Allocate’s policy that investment recommendations to its clients must be based on the investment objectives and risk tolerances of each individual client.

This page and Statements may contain or are based on third-party sources that, although believed to be reliable, have not been independently verified. Market and investment views of third parties presented herein do not necessarily reflect the views of Allocate. All such information is as of the date indicated, if indicated, may not be complete, is subject to change. All rights to the trademarks, copyrights, logos and other intellectual property listed herein belong to their respective owners and the use of such logos hereof does not imply an affiliation with, or endorsement by, the owners of such trademarks, copyrights, logos and other intellectual property.

Past performance is not indicative of future results.

“The Leveraging of Silicon Valley”, Jesse Davis, Adair Morse, & Xinxin Wang, University of California, Berkeley, November 2018

“Venture Debt Overview”, Kyle Stanford & Darren Klees, Pitchbook, October 2019

Pitchbook-NVCA Venture Monitor data, Q4 2023

“What Are Warrants and Are They Good For Startups?”, Lighter Capital, Accessed 23 February, 2024

“The Founder’s Guide to Venture Debt”, Flow Capital, Accessed 14 February, 2024

“Venture Debt: Equity Venture Capital’s Little Brother”, Richard Hillson, January 2023, Accessed 20 February, 2024

“What is the Average Default Rate of a Venture Debt Portfolio”, Vanessa Kruze, Kruze Consulting, Accessed 22 February, 2024